Oil Block Sale

Oil Block Sale

Exploration & Production Project

Gulf of Guinea

Executive Summary

The Gulf of Guinea

- The Gulf of Guinea is, without doubt, one of the most prolific oil and gas provinces in the world. The region has been, and will continue to be, an area for world class oil discoveries

- It is set to become an increasingly important source of oil for the United States and Europe as they seek to reduce dependence on the Middle East.

- Existing significant oil and gas production and good infrastructure exists to support the increased levels of exploration and production activities

- All of the Super Majors, ExxonMobil, Shell, BP, Total, ConocoPhillips has production and exploration acreage in this basin.

- Deepwater oil is the growth play in the oil industry, with it offering the lowest risk and best-returning growth available to global oil companies

Block 6 in the JDZ

- Block 6 is considered to be most attractive of the Blocks in the Joint Development Zone (JDZ) in the Gulf of Guinea.

- From a geological perspective Block 6 sits in close proximity to numerous large discoveries indicating the low risk of this venture

- The JDZ has the most generous tax systems in the Gulf of Guinea and one of the most generous tax systems in the world making this a very attractive province to produce oil

- Only 35% of the block has seismic shot across it. Within the area shot there is identified 4 prospects, with the following estimated reserves as defined by the JDZ and thus an independent source:

- a. The reserves in place are estimated to be 4.4 billion barrels of oil and 2.8 trillion ft3 of gas

- b. Estimated Risked Recoverable Reserves of 550 million barrels of oil and 830 bcf of gas (or 688 million barrels of oil equivalent)

- The value of this prospect alone is US$2.05 billion risked. This excludes any value for the gas. The rate of return on this prospect is 56%. If the gas is added the value increases to just over US$3 billion and the return to in excess of 70%.

- It is reasonable to expect that at least 1 further prospect exists in the block once the remainder of the block is explored, giving a risked value of perhaps US$4.1 billion risked for oil development alone and US$6 billion if gas is included.

Block 6 offers a considerable low cost entry into a prolific basin with massive production and future reserve potential and commensurately high returns

Overview of the Gulf of Guinea

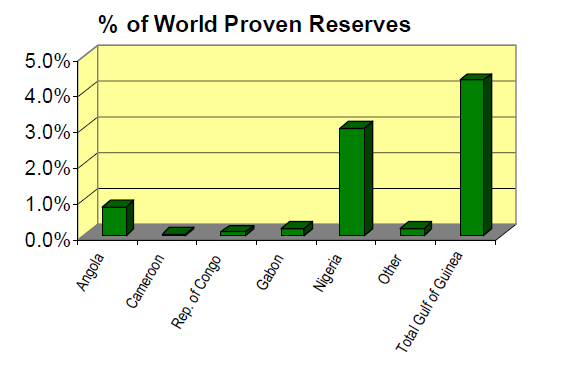

The Gulf of Guinea is, without doubt, one of the most prolific oil and gas provinces in the world. The region has been, and will continue to be, an area for world class oil discoveries, in particular within the Niger Delta. As shown in the table below the Gulf of Guinea, as at end 2003 held some 4.5% of the world oil reserves. With the exception of the Middle East this is the largest concentration of oil reserves in a single confined basin.

The Gulf of Guinea is not only rich in oil reserves but has significant gas reserves. Currently the gas reserves, which represent some 3% of world proven reserves, remain largely untapped. The only significant exporter of gas is the Bonny Island LNG project. There are numerous pipeline projects under consideration to pipe the gas north to the Mediterranean to capture the lucrative European market. Thus there exists considerable upside as the gas is not included in the estimates for returns.

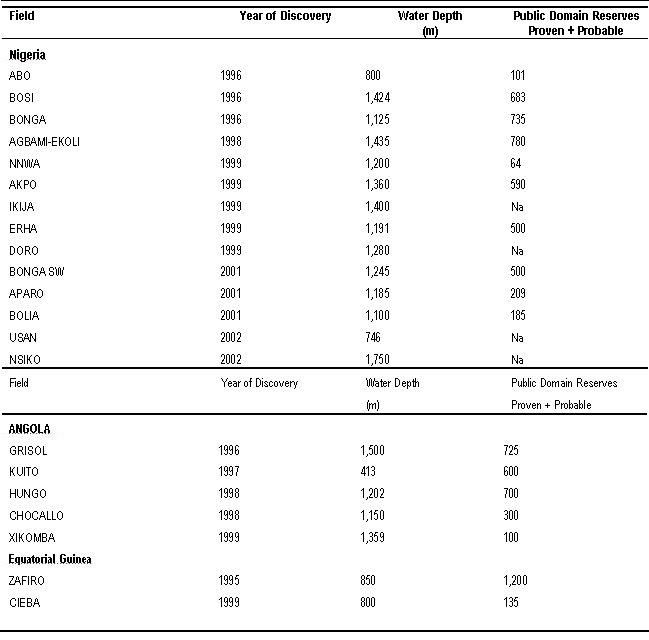

The Gulf of Guinea is currently producing approximately 5% of world-wide production, confirming it status as a significant oil and gas basin. Intensive exploration efforts over the last 35 years in and around the Niger Delta in particular has led to a succession of significant discoveries, notably the Bonga, Agbami/Ekoli and Akpo discoveries in Nigeria and Zafiro and Alba in Equatorial Guinea. However, the full potential of the continental slope and rise seaward of the shelf break is only recently becoming apparent, with a number of exploration programs having resulted in world-class discoveries being made in recent years. Few basins in the world can boast such a concentration of massive discoveries.

The Turbidite systems in terms of submarine fan models are the main exploration strategy. Nigeria deepwater turbidities include particularly the following:

- 1. Amagamated chanels

- 2. Isolated Channel Complex

- 3. Sinuous Channels

- 4. Channel sands complexes and

- 5. Levee/overbank deposits

The majority of the deepwater wells evaluated the turbidite reservoir sands of the middle Miocene to Oligocene age in slope and basin fan settings.

By the discovery of the world-class standard fields in the region, Nigeria deepwater and now particularly The Nigeria – São Tomé and Príncipe Joint Development Zone (JDZ) is a region of extreme interest. Initially operators of the deep offshore blocks had restricted drilling operations to depth of 200m or below, but with the acquisition of high-resolution 3D seismic and well control, there has been a far better understanding of the geology, thus drilling further offshore in to the deeper water depths of 2,000 m has tripled the discovery rate.

The Petroleum system and Basin modelling work carried out by the operators revealed that the Turbdite associated shales from Mid-Miocene and late Oligecene age are Kerogen Type II & III, which are co-producers of oil and gas in addition to massive, mobile and over-pressured underlying marine shales. The deep exploration in Nigeria has reached an advanced stage. The update of oil and gas discoveries has revealed impact or “elephant sized” exploration in the region and deepwater production has commenced proving the systems. Similar geological systems are present in the other regions of the gulf of Guinea.

This focus on the deepwater in the Gulf of Guinea has lead to discoveries in the deepwater environment as follows:

A good infrastructure exists in the Gulf of Guinea to support the increased levels of exploration and production activities, notably in Nigeria. The historical levels of oil production in Nigeria have led to a network of onshore oil pipelines linking fields and the main oil refineries. Petrochemicals are produced at a number of sites, including Warri and Port Harcourt.

All of the major oil services companies have offices in the region, and new oil services centres, such as the Onne Oil and Gas Free Zone and the Luba Freeport, are being developed at an increasing pace. Gas pipelines are planned to export gas from Nigeria to Ghana (the West Africa Gas Pipeline and Algeria (the Trans-Saharan Gas Pipeline). Increased use is being made of the gas produced in the region. A feasibility study is underway for a gas-to-liquids (GTL) plant at Escravos. New developments at the Bonny Island LNG plant, which represents one of the single largest processing investments in Nigeria, will increase output capacity to 17.3 million tons per year of LNG, 2.5 million tons per year of LPG and 1 million tonnes per year of condensates. New LNG plants are planned at Brass River and Bioko Island, Equatorial Guinea.

Deep Water Prospectively and The Gulf of Guinea

Most experts believe that there are some 60 billion barrels of oil equivalent (boe) which are proven to lie under the world’s seabeds – mostly in waters off the West Africa, Brazil and Gulf of Mexico. Seismic studies suggest the possible presence of another 40 billion. While deepwater prospectively exist in Asia, particularly around Indonesia and Malaysia it is not considered to be in the same category as the Gulf of Guinea in terms of reserves to be found.

In a recent report by Deutsche Bank they conclude that:

- deepwater output will total eight million barrel of oil equivalent per day by 2010, twice current volumes and three times higher than the industry growth average

- Deepwater oil is the growth play in the oil industry, and they believe deepwater is the lowest risk and best-returning growth play available to global oil companies.

- The deepwater prospects are very attractive because they are mostly in places accessible to big oil companies – The Gulf of Guinea and the Gulf of Mexico – without the constraints and instability of Middle East oil or the transportation problems of the Caspian (in central Asia)

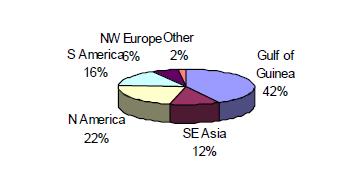

This focus on the Deep water by the oil majors can be seen form the recent survey by the Industry magazine “Offshore”. In their December 2004 edition they predict that of the $48 billion worldwide deepwater capital expenditure over the next 10 years some 42% will be aimed at West Africa. Further demonstrating the absolute attractiveness of the region.

This focus on the Deep water by the oil majors can be seen form the recent survey by the Industry magazine “Offshore”. In their December 2004 edition they predict that of the $48 billion worldwide deepwater capital expenditure over the next 10 years some 42% will be aimed at West Africa. Further demonstrating the absolute attractiveness of the region.

Summary

The Gulf of Guinea represents one of the fastest growing areas with significant growth potential. It is an attractive investment area given its relative political stability, the fields are largely offshore and so distant from regional issues, ideally positioned to export the produced hydrocarbons to the key markets of the US and Europe, and is an area highly attractive to the major oil companies. In this respect, the Gulf of Guinea offers one of the best investment opportunities in the oil and gas industry today. It has highly prospective acreage that is within the reaches of today’s technology.

Licences in the JDZ

Background to the JDZ

Chrome Energy, a made an agreement with the São Tomé and Príncipe Government to shoot speculative seismic over the are in return for having a 49% interest with the São Tomé and Príncipe Government. They formed a joint venture company ECRH. After shooting the seismic ECRH brought in Exxon Mobil as their technical and financial partner with a 60% working interest on the whole area.

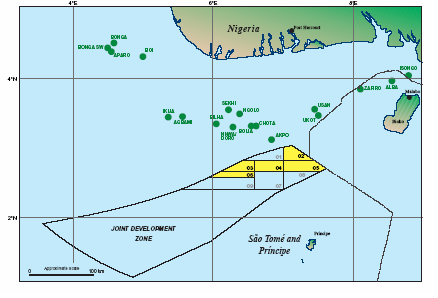

The Nigerian government disputed São Tomé and Príncipe Government’s right to unilaterally assign this area overlapping maritime area and set up a work group to agree on the best way forward. The result of this was to form the Nigeria – São Tomé and Príncipe Joint Development Zone (JDZ). This is defined by formal bilateral Treaty, and is the area of overlapping maritime boundary claims that is now being jointly developed to the benefit of the two countries. The Joint Development Authority (JDA), which has its headquarters in Abuja and a liaison office in São Tomé, manages the development of the natural resources of the JDZ.

When the licensing round was awarded the São Tomé and Príncipe Government recognised the rights they gave to ExxonMobil and ECRH and thus these companies were assigned certain pre-emptive rights. Both ExxonMobil and ERCH have exercised their rights and it is through the exercising of these rights that ECRH have a15% interest in Block 6.

OPEC member, Nigeria, is Africa’s largest oil producer and the tiny West African archipelago of Sao Tome and Principe will be the latest entrant into the sector. Oil companies have already made several huge oil discoveries in the deep waters of the Gulf of Guinea, and 20 companies, including Shell, ChevronTexaco, Total and Statoil, submitted bids for JDZ acreage in October. In the first licence round only Block 1 was awarded to a consortium of Exxon Mobil (Operator), Chevron Texaco and EER (a joint venture between a Norwegian and Nigerian drilling contractor). The signature bonus was $123 million.

5 blocks were offered in 2004 with a deadline in December 2004. A total of 23 applications were received with a total of $433 million in signature bonuses being offered. Block 2 received a signature bonus offer of $175 million and Block 2 $135 million. The other 2 blocks 3 and 5 received bonus offers of $37-$45 million. The number of applications and the size of the bonuses offered again confirms how highly rated this area is.

Region Seismic Work

Extensive regional 2D and 3D multi-client seismic data shot by a number of seismic contractors provide a high quality regional dataset that has enabled unprecedented insight into the tectono-stratigraphic evolution of the Niger Delta and especially the deep-water province. The total sedimentary prism, an area of some 140,000 km2, has a maximum stratigraphic thickness of about 12 km. The JDA has performed detailed reviews of the data and have performed its own interpretation to assist it in the bid review, PSC negotiation and management of the exploration and development of the JDZ. The consortium through its high level contacts has been given access to this analysis and the following review provide a high level overview of this detailed work.

For more information contact us by filling the form at:

BLCO Buyer Registration

Thank you,

Jeff Scott – CFO