DIRECTORS

Oluwakemi Kasali

and

Jeffrey Scott

Nigerian Oil Services

+234 805 953 5778

+1 763 898 0477

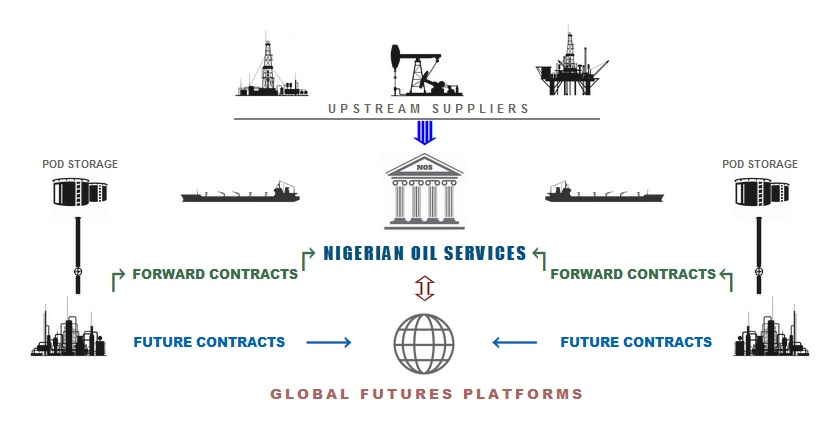

Nigerian Crude Oil Forward Exchange Platform Explanation - Click to Open

We purchase crude oil from upstream suppliers and off-OPEC sellers using FOB incoterms. We deliver the product to our storage facilities that hold the product for forward and futures contracts until those contracts are settled. We match the terms of the futures contract in order for the platform to secure the contract and legitimize its existence. We take the product and store it for a later date in the buyers port. The storage facilities are all over the world in order to easily accommodate end user refineries or resellers that purchase the futures contracts or our forward contracts.

Finally, Nigerian sellers can find a real buyer that is RWA to make a purchase and own the product.

There are several impediments in order to execute and actually finish forward contracts. These impediments have constrained the sale of crude oil, especially for the Nigerian marketplace. This has resulted in a premium product better than Brent and WTI being sold on the physical market for less than the cost of those two benchmark products.

These “futures” are contracts where the closing date is written into the future. Therefore almost all crude oil contracts that involve the physical sale of crude oil are really forward contracts. They could be dated anywhere from a few days to a few months into the future.

In the crude oil finance market, a forward contract or simply a forward is an over the counter (OTC) non-standardized contract between two parties to buy or to sell crude oil at a specified future time at a price agreed upon today, making it a type of derivative instrument. The refiner agreeing to buy the crude in the future assumes a long position, and the supplier agreeing to sell the crude oil in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into.

The price of the underlying forward or futures oil contract, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the value date where the securities themselves are exchanged.

Forwards, like other derivative securities, can be used to hedge risk (typically currency or exchange rate risk), as a means of speculation, or to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive.

In most oil contracts the price is fixed to the floating price of Brent, usually fixed as a discount to the three day average of "dated Brent". So in most cases the future cost of the contract is not fixed, as it would be in a forward contract for other commodities. In stead the margin between Brent and BLCO or some other Nigerian Crude oil is fixed.

One of the reasons for this is that delivery of the product could take up to 60 days of on-the-water time. So it is understood that the price of the crude oil would slide up or down to accommodate changes in the overall market conditions. Both buyers and sellers have accepted this flexibility because refined product prices are also flexible.

Pump price changes have been accepted in the marketplace. Forward contracts generated on a world-wide commodities exchange in the oil market are really more attached to the futures market than to the actual physical marketplace.

You may regard Nigerian Oil Services BLCO Trading and Exchange Platform as a “forward and spot” platform because of our attachment to the futures commodities market, but as you read on you will see a distinction from that idea.

Continued Below

&

Crude Oil Forward & Futures Exchange Platform

Illustration Explanation

When futures contracts are created on international commodities platforms they are occasionally settled by executing an exchange for physical (EFP) (double ended arrow above the globe). This notice to the platform converts a futures contract to a forward contract. Then that forward contract is an OTC contract requiring physical delivery. The terms of the contract are then changed to satisfy the buyers needs.

Nigerian Oil Services can create these EFPs for our clients and also fulfill these contracts for the platforms.

Nigerian Oil Services also executes forward contracts directly with refineries.

NOS has a stable of ready upstream suppliers which we purchase from on FOB incoterms, removing the supplier's risk and providing them immediate profit.

We then deliver against a refinery commitment letter to the buyers port of delivery (POD) and also provide the refinery terms, using a bank instrument, so that they can pay for the feed stock out of the profits they generate from refining and selling fuels.

This allows refineries a zero risk procurement while acquiring a premium ultra low sulfur lite crude oil with the highest first run percentage of middle distillates available on the planet.

&

There is a marketplace lag in price changes. Crude oil prices, priced off the dated Brent price, change according to world conditions. The refineries absorb those immediate changes and then when their fuels are produced they pass those price changes on the the wholesalers.

The wholesalers then pass those prices on to the retailers and the retailers then raise the pump prices.

Though, in the petroleum marketplace there is often a vertical structure to the business. The same company that is pumping the crude out of the ground is often the same or sister company that is selling retail.

This condition has changed some what as the refineries were sold by the majors to more local concerns but the pricing flexibility in that market is traditionally institutionalized. Because of price time lags in product pricing, refineries make more money when the price of crude is dropping and less money when the price is rising. Which is exactly opposite to what the public thinks. They think they are getting gouged by price increases and believe the refiners are making more profits when the pump price is rising.

Forward Price Contracts

Getting back to forward price contracts, these forward contracts have found a place in between physical crude oil contracts and the hedging utilized in the futures market.

The futures market rarely settles contracts by delivering product. Rather it settles futures contracts with cash at the time the paper ownership is transferred.

Exchange for Physical

If physical product is required by the buyer of the futures contract, then an Exchange for Physical is initiated by serving notice to the futures exchange platform.

When this happens there are usually new conditions that are introduced to the contract. These new conditions could be price, specifications as to the type of product to be delivered, the date of delivery; and these changes customize the contract so that the buyer actually get their preferred product rather than Brent, WTI or some other crude. Then if the product required by the buyer is a Nigerian ultra low sulfur light crude oil then we take the delivery responsibility.

“ Nigerian Oil Services Manages DeliveryNigerian Oil Services serves the commodities platform to provide contracted physical crude oil to satisfy the futures and forwards contracts that require future delivery of the physical crude oil.

What this does is to remove the stigma of off-OPEC irregularities (which keeps the off-OPEC pricing at a minimum) and replaces the irregularities with consistency of quantity, quality and secured delivery. The end buyer will eventually pay more for the product because their risk has been removed.

The physical delivery is often initiated prior to contract origination and settlements and is made to crude oil depots that can accommodate that much product in storage until the contracts are settled. Continued Below

&

So when the contracts are settled the product is already in the buyers port. No more guessing whether the product will arrive or if the quantity and quality is up to snuff. The Q&Q of product has already been completed.

Nigerian Oil Services can contract for other light sweet crude oils, a list of which is available on this page of our site. Crude Oil Specifications

Our BLCO Trading Exchange Platform is then carrying the price risk over time and the possibility that the product may not be contracted for a purchase.

We do this by taking ownership of the product and working with the international commodities platforms to secure futures contracts that are likely to need physical product delivery fulfilled.

This means there is already a market for the product and depots in place to complete distribution chain.

Now our buyers (refineries) can secure a forward contract with Nigerian Oil Services and know their product will be there prior to the settlement date. That contract is then put on the commodities exchange platform legitimizing the transaction. Or the contract originates there (futures) and we are assigned to fulfill it.

This also means sellers of Nigerian crude oil now have a legitimate buyer that takes delivery FOB and purchases the product as soon as the sellers inspection has been completed.

Finally Nigerian sellers can find a real buyer that is RWA to make a purchase and own the product.

END

Platform Storage Locations :

A New Paradigm In crude Oil Contracting - Click to Open

Crude Oil Contracting Without Risk

The purpose of a contract is to spell out the conditions for the sale and transfer of physical ownership and documentary ownership between two consenting parties so that they agree to the terms of that transfer and come to have expectations that are supposed to be bound into the future.

But the nature of a contract is such that performance between both parties remains questionable. Will the seller deliver a specific quality and quantity on time? Will the buyer pay for the product as contracted?

The consequence these two questions impedes the liquidity of the marketplace, and affects price. The traditional answer to these two questions is spelled out in two ways. Do the parties have enough money or reputation and do they have a history of performance?

There are also certain protocols that when inserted into a contract tend to provide a more assured delivery of the product.

One such procedural feature is a performance bond. It provides financial compensation for non performance. These PBs are expensive and are usually not offered except where the cost two both parties has risen due to the cost of bank instruments.

Further, both parties do not always agree on the procedure of the procurement of the bank instrument. This added level of complexity brackets the contract into two different contracts ideologically – one for the bank instruments and one for the product.

The objective in performing (settling and fulfillment) a transaction is not to increase complexity. It should be to reduce friction and make the purchase easier.

The Nigerian Oil Services trading and exchange platform has put in place a procedure that breaks the norm. While there are always two contracts when a reseller involved; one with the supplier and one with the end user; there is no rule that both contracts need to look similar.

What our trading and exchange platform has instituted are two transaction that remove the risk, first to the supplier and second to the end user.

For the supplier the platforms capital (SBLC) is already in place with a fiduciary organization guaranteeing payment after delivery. The delivery location is known by our platform. The time of the lift is known. All of the conditions upon which the product has been transacted are known. The contract with the supplier is really an FOB purchase. This removes the suppliers concerns.

The product is then delivered on a forward contract to the end buyer. The buyers financial commitment is not executed until the buyer has already had the opportunity to inspect the product in their own port, the port of delivery (POD).

In this way, all of the buyers natural resistance to contracting has been removed since he is not making a financial commitment until after he has measured the quantity and quality of the product in his own facilities.

&

Further the platform offers terms to the end buyer so that he can actually pay for the product after he has refined the product and sold the resultant fuels.

All of the complexity and risk then belongs to the Nigerian Oil Services Forward and Exchange Platform, and the risk on both ends of the transaction has been removed.

“ Institutionalized procedural consistency has replaced uncertainty.Then the only question remaining is, can the the platform actually perform while absorbing all of the risk?

The answer to this question really gets to the money involved. Does the platform have enough capital in order to absorb the risk and compensate service providers to do their jobs to accommodate a smooth delivery process?

The answer to this is that the platform has also provided all the necessary set-asides with their fiduciary financial institution in order to lay aside all of the concerns of the logistics supply chain about their performance compensation. Everybody involved has been guaranteed compensation for their services through financial set-asides in the form of reserve cash accounts or bank instruments guaranteeing compensation after performance.

So when a supplier and an end buyer (refinery) contract with the Nigerian Oil Services Platform they know their written obligations will be satisfied and fulfilled.

END

Four Critical Infrastructures Required of a Commodities Platform

Dependable Logistics

in 18 jurisdictions worldwide

Dependable Logistics

Criteria:

FOB Procurement Simplicity

Readibily Available Vessels

Export Authority Secured

Platform Tracking

Inspection Competency

Discharge Scheduling

Controlled Storage

Outcome: Just-in-time Delivery

Credible Contracting

in 14 jurisdictions worldwide

Credible Contracting

Criteria:

Open Access

ICC Compliance

Contract Consistency

Standardized Execution

Margin Compliance

Flexible Terms

Professional Fulfilment

Outcome: Reliable Results

Systematized Operations

in 21 jurisdictions worldwide

Systematized Operations

Criteria:

Integrated Network

Cloud Infrastructure

Platform Connected

Transaction Control

Retainer Consistency

Agile Improvement

Outcome: IT Best Practices

Supply Chain Finance

in 19 jurisdictions worldwide

Supply Chain Finance

Criteria:

Total Capitalized Finance of:

Compliant Export

Reliable Delivery

Bonded Performance

Dependable Fulfilment

Outcome: Trustworthy Supply